LVLFI has created a solution for corporate employees or financial customers to:

- Understand their current financial situation

- Learn about their financial options

- Be rewarded to plan for the unexpected and for their financial future

Identify > Understand/Educate > Call to Action > Reward

We all know that we need to plan for the future. Whether it’s buying life insurance to protect our family, or putting enough money away to build a pension to keep us financially secure when we retire. However, these products are often complex, difficult to understand and too easy to put off for another time after a hard day’s work.

LVLFi is here to change that. We use gamification and behavioural economics to make it more fun and rewarding to both learn about your current financial situation and finance options available, and also to take action – to make choices and follow through to safeguard your financial future today.

TAKE ACTION – GET REWARDED

Reward your employees for taking action to help their future. We make the

rewards process exciting, encouraging employees to get more involved.

- Give them Life insurance coverage so that they are enrolled and have a policy. Often the hardest part is to enrol your employees, then let them purchase additional coverage for their needs.

- Match their life insurance contributions: up to a certain limit, give them 1:1 or even more matched premium contributions each month.

- Directly put money into their fractional share trading account. Let your

employees become part of the share owning generation, by funding a long-only fractional share account, allowing them to purchase and sell company shares or market funds from as little as £1. - Make contributions to their pensions, or offer matched or greater contributions.

- Win a small prize: keep things fun by offering your employees a chance to win a free coffee or Amazon gift voucher.

User’s can spin the wheel when they take certain predefined actions. This could be:

- Taking 10,000 steps per day

- Reading an article and answering questions about financial products

- Making a contribution to their pension

- Making a contribution to their Life insurance policy

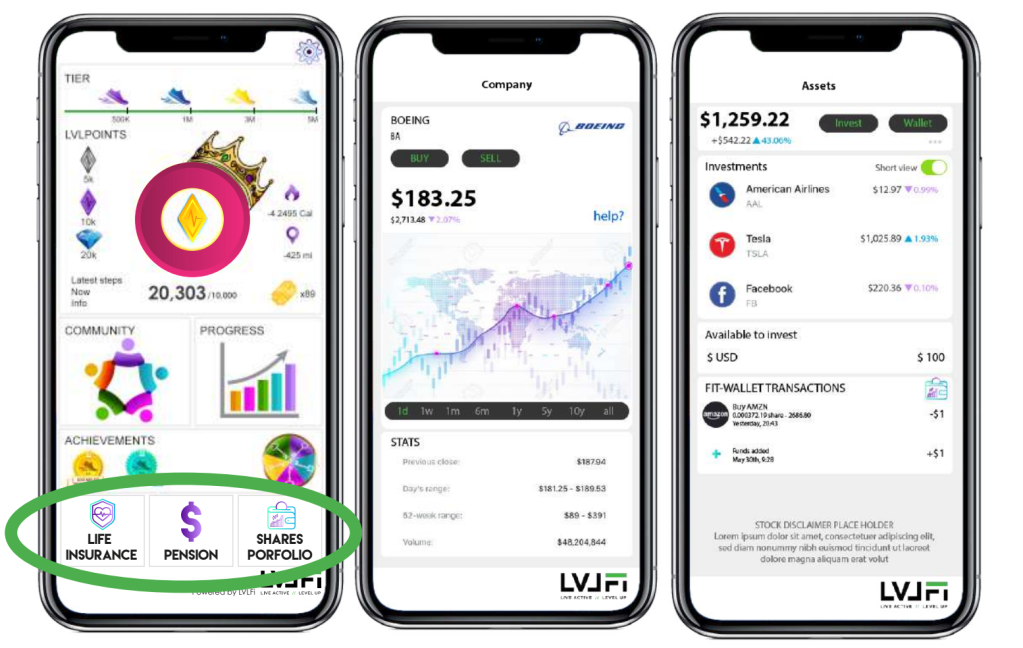

Life Insurance: Sign users up for life insurance and give them small amounts of insurance for free for being an employee. Allow them to learn and manage their insurance needs in one place, seeing the amount of coverage they have and able to experiment withdifferent rates of coverage.

Pension: Allow users to see their current pension contribution and experiment to see what their pension could be if they increased/decreased their contributions.

Shares: Fractional Share trading: Allow your employees to build up a portfolio of investments. They can have funds deposited directly into their trading account, and then buy shares or market tracking funds for as little as £1. It’s exciting and gives a feeling of ownership to the employee about their financial future.